43 irs mileage rate 2022

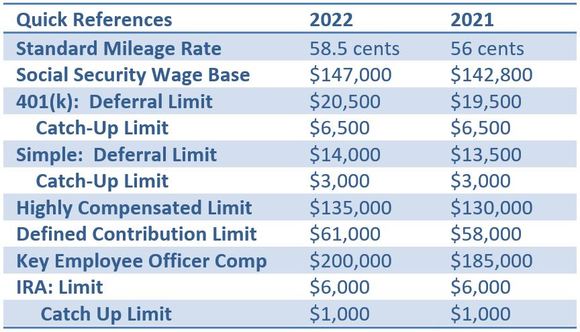

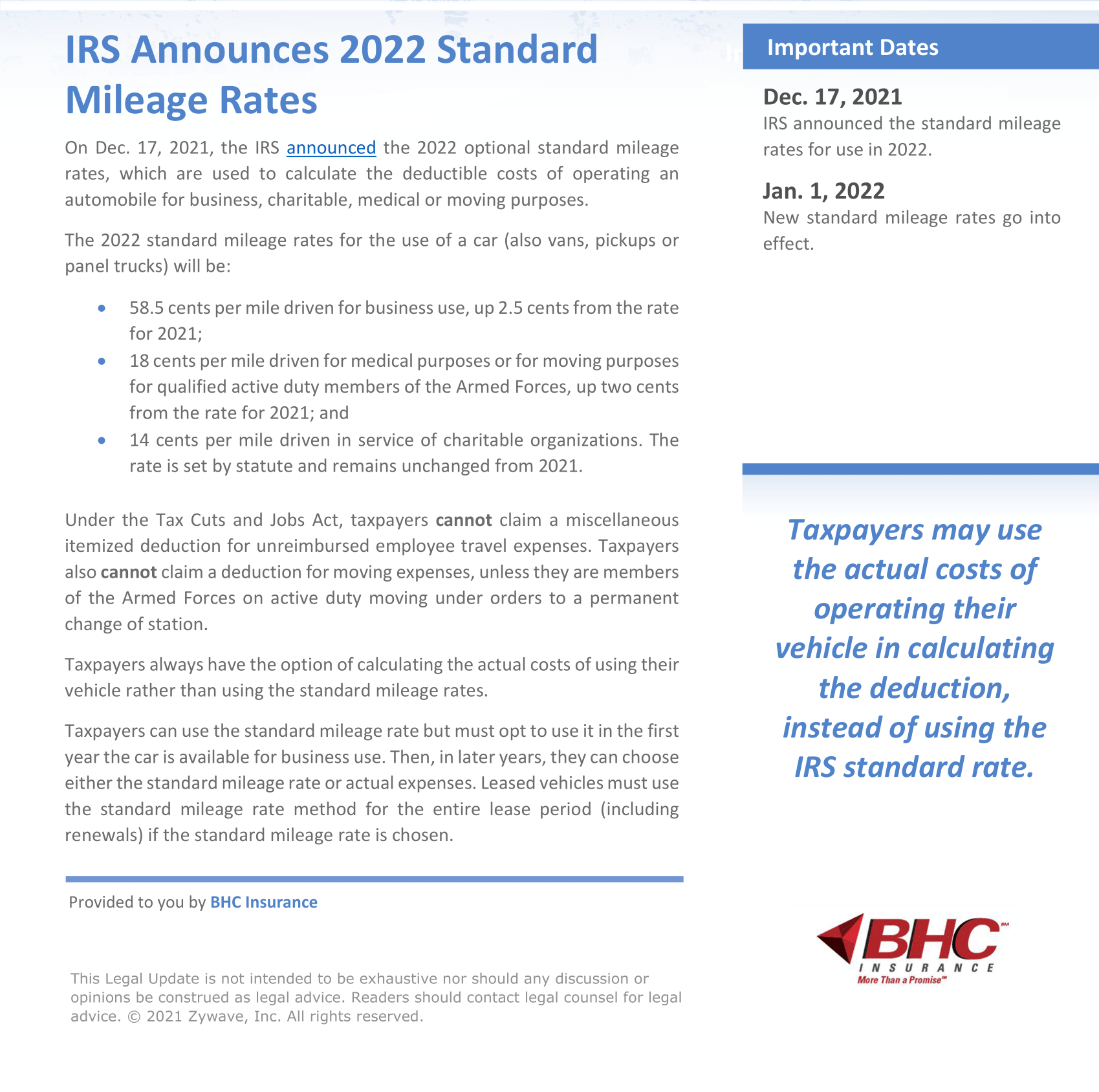

What Are The 2021-2022 IRS Mileage Rates? - Bench 04.03.2022 · The IRS increases the mileage reimbursement rate each year to keep pace with inflation. For many businesses, mileage is the largest deductible cost on their tax return. There are two ways to calculate your mileage deduction: The standard mileage rate, and the actual expense method. We’ll compare the two, so you can choose which is right for your business. … What is the IRS Mileage Rate for 2022? - File My Taxes Online The IRS mileage rate is typically updated each year, and the new rate for 2022 has just been announced. The current rate is 58.5 cents per mile. If you're planning on doing a lot of driving in the next year, be sure to keep this in mind and factor it into your budget.

How to Log Mileage for Taxes in 8 Easy Steps 28.12.2021 · The standard mileage deduction requires only that you maintain a log of qualifying mileage driven. For the 2022 tax year, the rate is 58.5 cents per mile for business use, up 2.5 cents from 2021.

Irs mileage rate 2022

Irs Travel Mileage Rate 2022 - Latest News Update Standard optional mileage rates for 2022 for 2022, the business mileage rate is 58.5 cents per mile; 58.5 cents per mile for business purposes 18 cents per mile for medical or moving purposes 14. Irs Mileage Rate 2021 & 2022 For Different Purposes The Rates Of Reimbursement For Mileage Set By The Irs To Be Used In 2021 Are: 2022 Mileage Rate IRS | IRS Mileage Rate 2022 IRS Mileage Rate 2021 & 2022 for Different Purposes The reimbursement rates for mileage that are standard established by the IRS in 2021 are: 56 cents/mile for business mileage (reduced by 57.5 cents/mile in the previous year). 16 cents/mile for travel as well as medical travel (reduced from 17 cents/mile over these three years). New IRS Standard Mileage Rates in 2022 - MileageWise The mileage rates do not cover the cost of parking and tolls and they do not vary by geography, it's the same amount throughout The United States. Taxpayers cannot deduct the private usage of the vehicle; IRS Standard Mileage Rates for 2022: 58.5 cents per mile for business purposes; 18 cents per mile for medical and moving purposes

Irs mileage rate 2022. IRS Mileage Rates For 2022 | Mileage Reimbursement Rate ... Businesses could anticipate the increase of IRS Mileage Rates For 2022 from the current rate of$0.56/mile to approximately $0.57 to $0.58/mile. IRS provides tax inflation adjustments for tax year 2022 ... The personal exemption for tax year 2022 remains at 0, as it was for 2021, this elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act. Marginal Rates: For tax year 2022, the top tax rate remains 37% for individual single taxpayers with incomes greater than $539,900 ($647,850 for married couples filing jointly). Standard Mileage Rate Definition - Investopedia 28.12.2021 · Standard Mileage Rate: A set rate the IRS allows for each mile driven by the taxpayer for business, charitable, medical or moving purposes. The standard mileage rate can be taken in lieu of actual ... IRS Mileage Rates for 2022: What Can Businesses Expect For ... The IRS officially published its optional standard mileage rates for 2022 on December 17th: . 58.5 cents per mile driven for business purposes (up 2 cents in comparison to 2021 rate) 18 cents per mile driven for medical/moving purposes (up 2 cents from the 2021 rate) The rate per mile driven in service of charitable organizations is set by ...

Federal mileage rates for 2022. - Nonprofit update. The IRS has published the reference amounts for mileage rates for 2022. The rates: Beginning on January 1, 2022, the standard mileage rates for the use of a vehicle will be: 58.5 cents per mile driven for business use, up 2.5 cents from the rate for 2021, 18 cents per mile driven for medical or moving purposes, up 2 cents from the rate for 2021 ... Internal Revenue Bulletin: 2022-12 | Internal Revenue Service SIFL Mileage Rates 1/1/22 - 6/30/22: $44.98: Up to 500 miles = $.2460 per mile 501-1500 miles = $.1876 per mile Over 1500 miles = $.1803 per mile. SIFL Rate Adjusted for PSP Grants 1/1/22 - 6/30/22: $33.88: Up to 500 miles = $.1853 per mile 501-1500 miles = $.1413 per mile Over 1500 miles = $.1359 per mile. SIFL Rate Adjusted for PSP Grants and ... Free Mileage Reimbursement Form | 2022 IRS Rates - Word ... Updated January 05, 2022. A mileage reimbursement form is primarily used by employees seeking to be paid back for using their personal vehicles for business use. Seeing as there is no way to properly calculate the true cost of performing the trip by the employee, the IRS announces these rates on an annual basis for employers and businesses. IRS Mileage Rate Explained | TripLog The standard mileage rate for 2022 is 58.5 cents per mile, but let's say you work in a high cost of living area. You could choose to reimburse them for more - let's say 62 cents per mile. Let's say your employee drove 200 miles in 2022. You would take that mileage and multiply it by the standard rate:

2022 IRS Mileage Rate: What Businesses Need to Know 19.10.2021 · As we get ready to flip the calendar to 2022, organizations are preparing themselves for what’s to come in the year ahead. At this time, the Internal Revenue Service (IRS) is also gearing up to release its annual mileage rate for the upcoming year.. While this rate has been used as a standard mileage deduction in years past, employees can no longer deduct … › en-us › moneyIRS Announces 2022 Mileage Reimbursement Rate Dec 17, 2021 · The IRS just released the 2022 standard mileage rate, and it comes with some increases. The rate goes up for business use and medical or moving purposes for qualified active-duty members of the ... Standard Mileage Rates For 2022 | IRS Mileage Rate 2022 14 cents/mile for volunteer mileage to a charitable organization. The increase that was determined for the IRS mileage rate was going to be announced by the end of December each respective year. It is predicted that for 2022 the mileage rate is going to be increased, but no more than a couple of cents. 2022 IRS Mileage IRS Mileage Rate 2022 Pdf IRS mileage rates for 2022 | Cornell University Division ... The Internal Revenue Service has issued the 2022 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business, charitable, medical, or moving purposes. Beginning on January 1, 2022, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) are as follows:

GSA / IRS Mileage Reimbursement Rate for Personally Owned ... 1) Standard Mileage Rate is used for travel in a Personally Owned Automobile (POA) when a government owned vehicle is not available or not in the government's best interest. You may drive no more than 400 miles a day. For travel farther than 400 miles, you must use commercial air-travel. 2) Government Vehicle Available Rate is given when use of a government owned …

› newsroom › irs-issues-standard-mileageIRS issues standard mileage rates for 2022 | Internal Revenue ... Dec 17, 2021 · Leased vehicles must use the standard mileage rate method for the entire lease period (including renewals) if the standard mileage rate is chosen. Notice 22-03 PDF , contains the optional 2022 standard mileage rates, as well as the maximum automobile cost used to calculate the allowance under a fixed and variable rate (FAVR) plan.

› sites › markkantrowitzNew 2022 IRS Standard Mileage Rates - forbes.com Dec 17, 2021 · IRS standard mileage rates will increase to 58.5 cents per mile in 2022, up from 56 cents per mile in 2021.

› ResourcesAndTools › hr-topicsIRS Raises Standard Mileage Rate for 2022 Dec 21, 2021 · The standard mileage rate that businesses use to pay tax-free reimbursements to employees who drive their own cars for business will be 58.5 cents per mile in 2022, up 2.5 cents from 2021, the IRS ...

› newsroom › irs-issues-standard-mileageIRS issues standard mileage rates for 2021 | Internal Revenue ... Dec 22, 2020 · Leased vehicles must use the standard mileage rate method for the entire lease period (including renewals) if the standard mileage rate is chosen. Notice 2021-02 PDF , contains the optional 2021 standard mileage rates, as well as the maximum automobile cost used to calculate the allowance under a fixed and variable rate (FAVR) plan.

Mileage Rate 2022 Washington State - Image Ideas The new irs mileage rates apply to travel beginning january 1, 2022. Source: roguevalleyguide.com. In the united states, the irs tries to make it easier by offering a mileage rate that is based on "an annual study of the fixed and variable costs of operating an automobile". Effective january 1, 2022, the mileage rate is 58.5 cents per mile.

ANNOUNCEMENT: IRS Mileage Rate Effective January 1, 2022 21.12.2021 · Subject: IRS Mileage Rate Effective January 1, 2022 The standard IRS mileage rate for the business use of an employee’s personal automobile has increased on January 1, 2022, from 56 to 58.5 cents per mile. The state bargaining agreements and compensation plans base mileage reimbursement rates on the standard IRS mileage rate that’s in place at the time of …

Publication 542 (01/2022), Corporations - IRS tax forms The interest rate for underpayments published quarterly by the IRS in the Internal Revenue Bulletin. A corporation generally does not have to file Form 2220 with its income tax return because the IRS will figure any penalty and bill the corporation. However, even if the corporation does not owe a penalty, complete and attach the form to the corporation's tax return if any of …

IRS Announces Mileage Rates for 2022 - mcb.cpa IRS Announces Mileage Rates for 2022. The IRS has issued the 2022 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business, charitable, medical or moving purposes. As of Jan. 1, 2022, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be.

Mileage Rate For 2022 | IRS Mileage Rate 2022 IRS Mileage Rate 2021 & 2022 for Different Purposes The rates of reimbursement for mileage established by the IRS for 2021 are: 56 cents/mile for business mileage (reduced from 57.5 cents/mile during the previous year). 16 cents/mile for moving and medical miles (reduced by 17 cents per mile since the last three years).

› 2022-irs-mileage-rate2022 IRS Mileage Rate: What Businesses Need to Know Oct 19, 2021 · What factors will determine the 2022 IRS mileage rate? The IRS monitors trends in business driving based on analysis from the world’s largest retained pool of drivers to calculate this rate, which is then used to determine taxation. If a company provides a reimbursement higher than the IRS standard mileage rate, that reimbursement becomes ...

How to Calculate Mileage for Taxes: 8 Steps (with Pictures) 21.01.2022 · The rate typically changes yearly, and if you're calculating for last year, it's important to double-check with the official IRS website against the figures described here below. X Trustworthy Source Internal Revenue Service U.S. government agency in charge of managing the Federal Tax Code Go to source The standard mileage rates for 2018 are as follows:

› en-us › moneyIRS Announces 2022 Mileage Reimbursement Rate Dec 17, 2021 · The IRS just released the 2022 standard mileage rate, and it comes with some increases. The rate goes up for business use and medical or moving purposes for qualified active-duty members of the ...

Mileage Rate 2022 Mileage Rate | IRS Mileage Rate 2022 16 cents/mile for travel or medical mileage (reduced to 17 cents/mile in 3 years ago). 14 cents/mile for volunteer mileage to a charitable organization. The final increase of the IRS mileage rate was will be announced by close of the month the next year. It is expected that in 2022, the rate will be increased, but no more than a couple of cents.

Standard Mileage Rates | Internal Revenue Service Standard Mileage Rates. The following table summarizes the optional standard mileage rates ...

2021 mileage reimbursement calculator 03.01.2021 · IRS fixes the standard mileage rate for business on the basis of an annual study of the fixed and variable costs of operating an automobile, whereas the mileage rates for medical and moving purposes is based on the variable costs. So, the new standard mileage reimbursement rates for the use of a car (also vans, pickups or panel trucks) from on January …

Will We See a Mid-Year Increase of the 2022 Standard ... However, the IRS already expected the cost of operating a vehicle to increase this year, and for that reason, they set the 2022 rate at 58.5 cents per mile, the same number as the 2008 adjusted rate. This means if they do decide to increase the rate this year, the adjustment likely won't be as drastic as in past years.

IRS Announces Standard Mileage Rates for 2022 For 2022, the business mileage rate is 58.5 cents per mile; medical and moving expenses driving is 18 cents per mile; and charitable driving is 14 cents per mile, the same as last year.

Topic No. 653 IRS Notices and Bills, Penalties, and ... 25.01.2022 · The one-half of one percent rate increases to one percent if the tax remains unpaid 10 days after the IRS issues a notice of intent to levy property. If you file your return by its due date and request an installment agreement, the one-half of one percent rate decreases to one-quarter of one percent for any month in which an installment agreement is in effect. Be aware …

2022 IRS Mileage Rate 2022 | IRS Mileage Rate 2022 IRS Mileage Rate 2021 & 2022 for Different Purposes The rates of reimbursement for mileage determined by the IRS in 2021 are: 56 cents/mile for business miles (reduced by 57.5 cents/mile in the prior year). 16 cents/mile for moving as well as medical travel (reduced to 17 cents/mile over these three years).

New IRS Standard Mileage Rates in 2022 - MileageWise The mileage rates do not cover the cost of parking and tolls and they do not vary by geography, it's the same amount throughout The United States. Taxpayers cannot deduct the private usage of the vehicle; IRS Standard Mileage Rates for 2022: 58.5 cents per mile for business purposes; 18 cents per mile for medical and moving purposes

2022 Mileage Rate IRS | IRS Mileage Rate 2022 IRS Mileage Rate 2021 & 2022 for Different Purposes The reimbursement rates for mileage that are standard established by the IRS in 2021 are: 56 cents/mile for business mileage (reduced by 57.5 cents/mile in the previous year). 16 cents/mile for travel as well as medical travel (reduced from 17 cents/mile over these three years).

Irs Travel Mileage Rate 2022 - Latest News Update Standard optional mileage rates for 2022 for 2022, the business mileage rate is 58.5 cents per mile; 58.5 cents per mile for business purposes 18 cents per mile for medical or moving purposes 14. Irs Mileage Rate 2021 & 2022 For Different Purposes The Rates Of Reimbursement For Mileage Set By The Irs To Be Used In 2021 Are:

.png)

/arc-goldfish-cmg-thumbnails.s3.amazonaws.com/12-28-2021/t_dffd77ff2a914b769ad109b3f44a2c7c_name_IRS_announces_the_standard_mileage_rate__61cb47f8b62da63ecbd8669e_1_Dec_28_2021_18_13_07_poster.jpg)

/Calculating_Mileage_for_Taxes_GettyImages-88327427-f6e3ca37a370470f9c3958ab60cf19dd.jpg)

0 Response to "43 irs mileage rate 2022"

Post a Comment