39 share buyback meaning

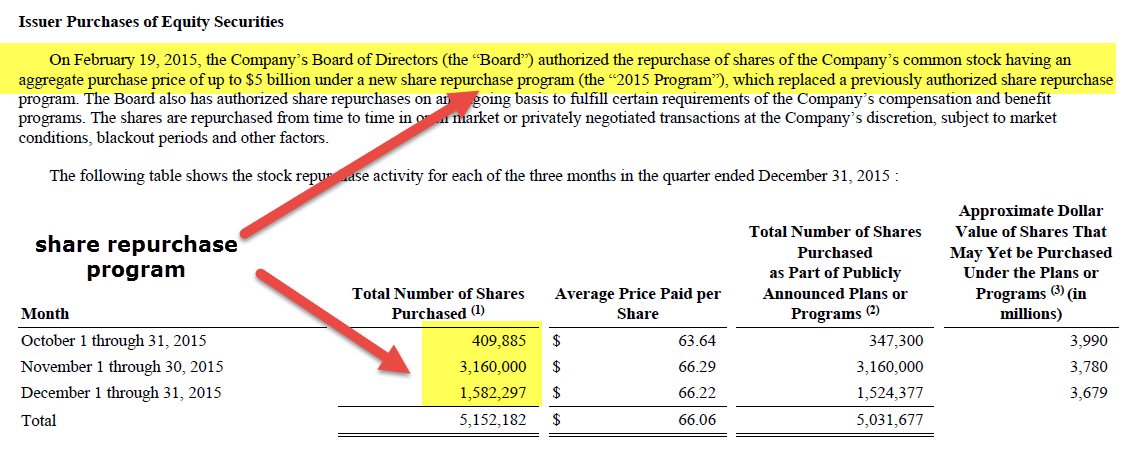

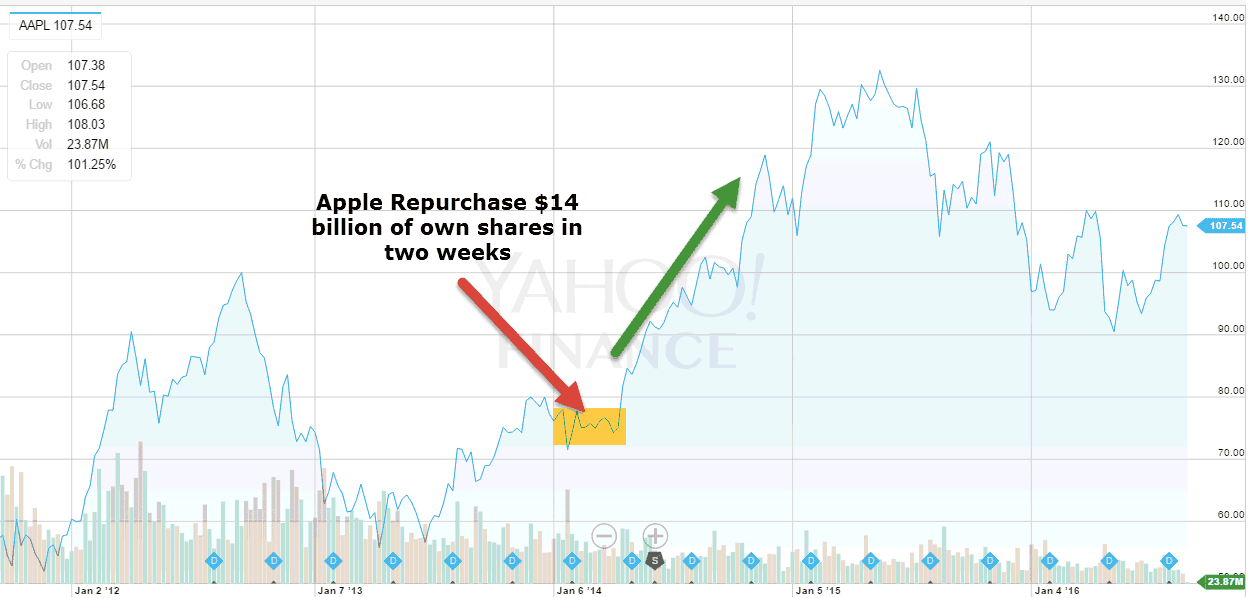

Share Repurchase - Overview, Impact, and Signaling Effect When a company buys back shares, it may be an indication that the company is facing very positive prospects that will place upward pressure on the stock price. Examples may be the acquisition of another strategically important company, the release of a new product line, a divestiture of a low-performing business unit, etc. Stock Buybacks: Why Do Companies Buy Back Shares? A buyback occurs when the issuing company pays shareholders the market value per share and re-absorbs that portion of its ownership that was previously distributed among public and private...

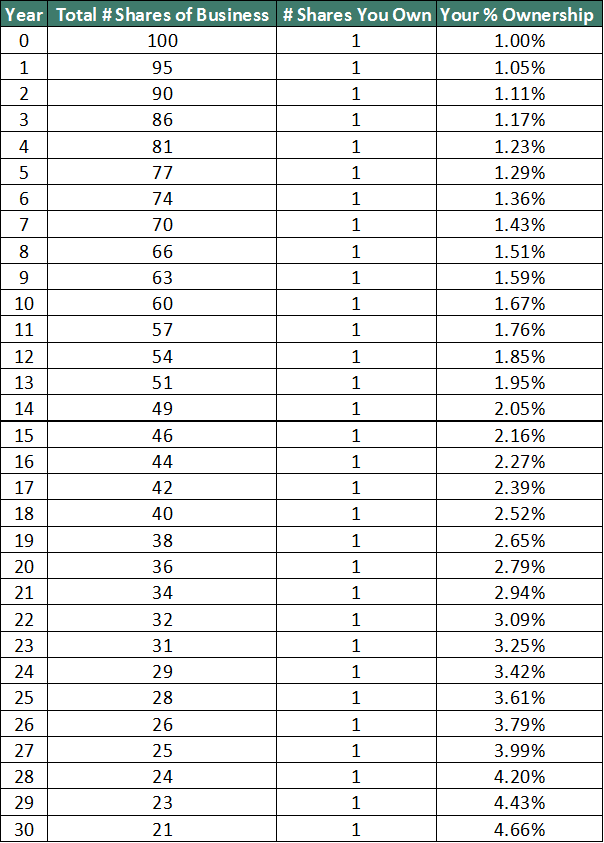

What Is A Share Buyback? Definition, Meaning & Basics Of ... In a share buyback, a company announces a price at which it is ready to buy shares from shareholders within a given time frame. Typically, companies with high cash reserves use the buyback route to reduce the number of shares in the market. Fewer shares can help return ratios and a reduced supply of shares can boost stock prices.

Share buyback meaning

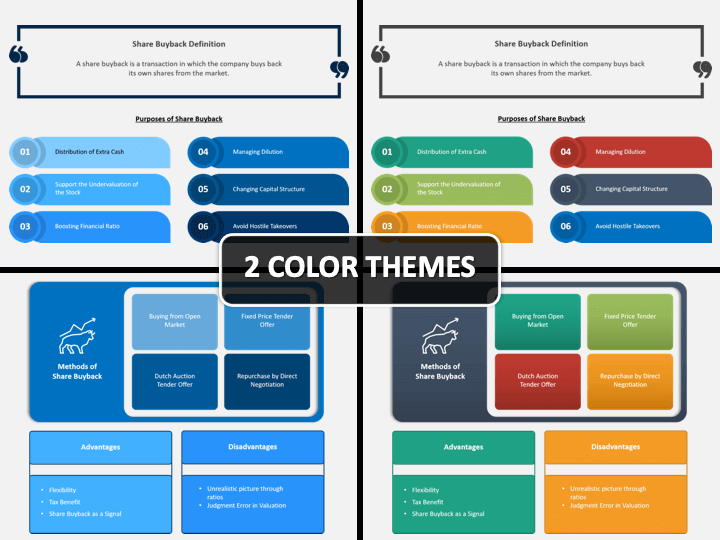

Share buyback - what this is and what a company needs to do A buyback of shares is where the company buys some of its own shares from existing shareholders. There are three types of share buyback: Purchase of own shares. Share redemption. Share capital reduction by: cancelling shares. repaying share capital. reducing the nominal value of a share class. Share Buyback | Definition, Example, Methods, Purposes A share buyback is a transaction in which a company buys back its own shares from the open market. Another term for it is share repurchase. There are various methods to buyback shares. The company can buy back the shares from the market or tender offer. The shares bought back will be reclassified as treasury shares or it will be canceled ... Buyback of Shares - Meaning, Reasons, Methods and ... Explaining what the buyback of shares is? A company can repurchase its own shares from an individual or a group of investors under the term buy back of shares. The buy-back is duly completed at a slightly higher price than the market value. The buyback of shares may be initiated by a company for various reasons, including the following.

Share buyback meaning. Share buyback financial definition of share buyback share buyback the purchase by a company of its own shares, thereby reducing the amount of its ISSUED CAPITAL. Share buybacks are undertaken to return ‘surplus’ cash reserves to shareholders; more particularly, they are undertaken to increase earnings per SHAREand DIVIDENDper share and thus (hopefully) lead to a rise in the company's share price. Buyback Definition Mar 10, 2022 · A buyback is when a corporation purchases its own shares in the stock market. A repurchase reduces the number of shares outstanding, thereby inflating (positive) earnings per share and, often, the... Share Buyback - Advantages, Disadvantages, and How Does It ... The share buyback is when companies buy back their own shares from the shareholders. There are multiple logics and methods that why the companies opt for buying back. However, shareholder's approval is required for the successful execution of the transaction. What is a share buyback? | Share repurchase definition Share buyback definition What is share buyback? Share buyback, or share repurchase, is when a company buys back its own shares from investors. It can be seen as an alternative, tax-efficient way to return money to shareholders. Once shares are repurchased they are considered cancelled, but they can be kept for redistribution in the future.

What is a share buyback? | Share repurchase definition | IG SG Share buyback, or share repurchase, is when a company buys back its own shares from investors. It can be seen as an alternative, tax-efficient way to return money to shareholders. Once shares are repurchased they are considered cancelled, but they can be kept for redistribution in the future. Share Buybacks: What It Means And How It Impacts Investors Definition of 'Share Buyback' A share buyback, or repurchase, is a move by a listed company to buy its own shares. This can be from the open market, issuing a tender offer, or arranging for a private buyback from a shareholder (s). Share buybacks are a corporate action that require companies to make a public filing with regulators. TCS share price rises marginally on last day of buyback ... The buyback is being done at Rs 4,500 per share - over 21 per cent premium to current market price. TCS shares were trading flat at Rs 3,706 on the Bombay Stock Exchange. The buyback offer ... What Is Buyback of Shares - Meaning, Process, Reasons and ... What is share buyback? Companies can sometimes decide to purchase their own shares from the open market, which they issued earlier, through a process called share buyback. When a company wants to buy back shares, it publicly announces its intention to do so through various channels.

Share repurchase - Wikipedia Share repurchase (or share buyback or stock buyback) is the re-acquisition by a company of its own shares. It represents an alternate and more flexible way (relative to dividends) of returning money to shareholders. Buyback of Shares Meaning, Procedure and Taxation Explained Buyback of shares meaning A buyback of shares is buying back of own shares by a company that was issued earlier. It is a corporate action event wherein a company makes a public announcement for the buyback offer to acquire the shares from existing shareholders within a given timeframe. Buyback Definition & Meaning - Merriam-Webster The meaning of BUYBACK is the act or an instance of buying something back; especially : the repurchase by a corporation of shares of its own common stock usually on the open market. How to use buyback in a sentence. Share Buyback (Definition, Examples) | Top 3 Methods Share buyback refers to the repurchase of the company's own outstanding shares from the open market using the accumulated funds of the company to decrease the outstanding shares in the company's balance sheet thereby raising the worth of remaining outstanding shares or to block the control of various shareholders on the company.

What is a Share or Stock Buyback? Upstox Share Buyback. A buy-back is a corporate action where a company offers to buy-back its shares from the existing shareholders usually at a higher price than the market price. I just read a very interesting story in which a shopkeeper loved his products so much that he went back to his customers and bought them all back.

Share Buyback | Reasons of Share Buyback | Share ... - EDUCBA The buyback of the shares is done when the company repurchases its own shares from the market. These shares are those which are already sold to private and public investors. Buyback of the shares is generally done at a higher price which is more than the market price of the share.

SHARE BUYBACK | meaning in the Cambridge English Dictionary share buyback noun [ C ] FINANCE, STOCK MARKET uk us (also stock buyback) an offer by a company to buy shares of its own stock from shareholders: Analysts still expect a share buyback at some stage. The company is pressing ahead with a €750 million share buyback programme. See also buyback Want to learn more?

Share buy backs | ASIC - Australian Securities and ... This type of buy-back, referred to as an employee share scheme buy-back, requires an ordinary resolution if over the 10/12 limit. A listed company may also buy back its shares in on-market trading on the stock exchange, following the passing of an ordinary resolution if over the 10/12 limit. The stock exchange's rules apply to on-market buy-backs.

What Is A Stock Buyback? - Forbes Advisor A stock buyback is when a public company uses cash to buy shares of its own stock on the open market. A company may do this to return money to shareholders that it doesn't need to fund ...

60 second guide: Share buybacks - CommBank Share buyback explained A buyback is when a company offers to re-purchase some of its shares from existing shareholders. The net effect is a reduction in the total number of a company's shares on issue.

Buyback of Shares Meaning - Ways, Participation, Pros & Cons Rule 1- The way shares are bought in the demat account is the same way the buyback of the share is done through a demat account. The buyback option will flash on the screen. Rule 2- investor needs to check the offer price and also for how many days the buyback offer is valid as during this time only the company will repurchase the shares.

What is a Stock Buyback? Definition & Benefits of Share ... 12.01.2022 · There are various ways in which profitable companies can return money to their shareholders, the most common of which are dividend payments.An alternate way is stock buyback (or share repurchasing), in which a company reacquires its own stock.The following post will look at the ins and outs of a share repurchase, why a company might choose to do …

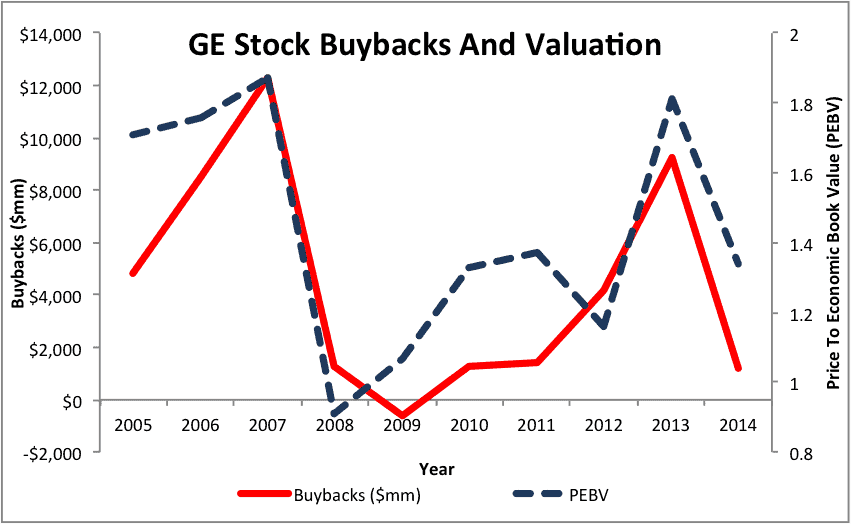

GE Surges on Plans for $3 Billion Share Buyback ... 09.03.2022 · Investing.com – General Electric (NYSE: GE ) stock gained 3.1% in premarket trading Wednesday after the company said it will buy back shares for up to $3 billion. Repurchases will be made from time to time in the open market, the company said without specifying an expiration date for the exercise ...

Buyback 2022: Upcoming & Latest Share Buyback Offers with ... Buyback of shares or stock buyback refers to the corporate action in which a company repurchases its own shares from the existing shareholders. During the buyback of shares, the price of shares is usually premium than the market price. Buyback of shares can be done via the open market or through tender offer route.

Share Buybacks - The Motley Fool UK As investing jargon goes a share buyback is one of the simplest terms. It's simply a company buying back its own shares. It can do this in one of two ways. The first, and by far the most common, is...

Buyback of Shares - Meaning, Reasons, Methods and ... Explaining what the buyback of shares is? A company can repurchase its own shares from an individual or a group of investors under the term buy back of shares. The buy-back is duly completed at a slightly higher price than the market value. The buyback of shares may be initiated by a company for various reasons, including the following.

Share Buyback | Definition, Example, Methods, Purposes A share buyback is a transaction in which a company buys back its own shares from the open market. Another term for it is share repurchase. There are various methods to buyback shares. The company can buy back the shares from the market or tender offer. The shares bought back will be reclassified as treasury shares or it will be canceled ...

Share buyback - what this is and what a company needs to do A buyback of shares is where the company buys some of its own shares from existing shareholders. There are three types of share buyback: Purchase of own shares. Share redemption. Share capital reduction by: cancelling shares. repaying share capital. reducing the nominal value of a share class.

/buyback-f91333fa039d4d79ab430c65fc753e11.jpg)

0 Response to "39 share buyback meaning"

Post a Comment